To put it mildly, the transformation journey, including the incorporation of generative AI into businesses, is not the main focus of this analysis. However, as observed from past studies, productivity can be enhanced by 30% to 50% through scaling generative AI applications. Furthermore, 95% of customer service leaders across the globe expect that AI bots will manage consumers in less than three years.

The first of the six parts of the webinar series was attended by expert leaders who discussed how operational excellence could lead to improvement in customer satisfaction through the application of artificial intelligence. The session was conducted by Kiran Kuppili, executive director & head of Institutional Banking Group and Payments, DBS Tech India, and Bala Natarajan, VP of generative AI and analytics at Capgemini, India.

A team of 3,500 executives is managed by Natarajan, who has amassed more than 28 years of expertise in data analytics, AI/ML, and business process management. He counsels multinational corporations on how to adopt AI for their transformation and on structuring data monetization strategies.

Kiran Kuppili was joined by Natarajan, a veteran of over twenty years in banking IT in the US, European, and Asian countries. Natarajan overseas managed the development of a conversational AI platform to her credit and continues to use other emerging technologies to facilitate the digital transformation of DBS Bank.

In that regard, this was the first of a series of webinars where professionals from different sectors and industries were keen on motivating them and igniting their interest towards data science and AI.

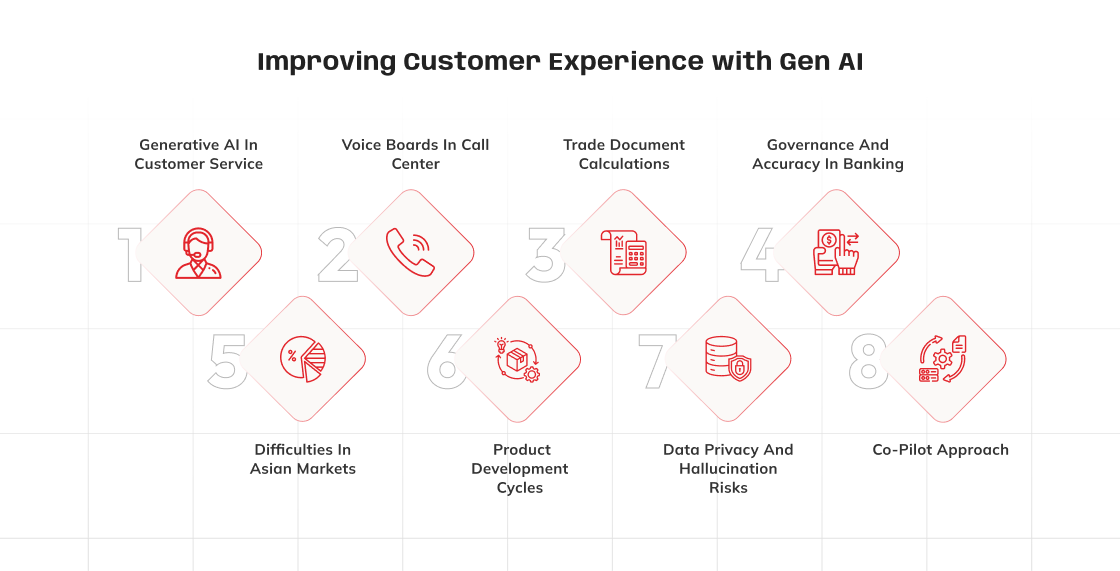

Generative AI in Customer Service:

The presentation focused on how customer service in different sectors is changing by using generative AI and highlighted automating several tasks and delivering suggestions tailored to the consumer.

Difficulties in Asian Markets:

The participants touched upon the difficulties related to the application of AI models in Asian countries, especially with languages and the more physical need for faster networks.

Voice Boards in Call Center:

As noted a voice board that allows for the automation of a wide range of tasks traditionally performed by human agents making it easier for an agent to deal with complex issues facing a customer.

Product Development Cycles:

This allows shortening of the product development cycles, powering productivity and efficiency thanks to the work of human teams and less time spent getting to market.

Trade Document Calculations:

An example which speakers shared showed generative AI in action in a customer service process: trade document calculations.

Data Privacy and Hallucination Risks:

The need to consider data privacy issues and hallucination risks when designing products with generative AI

Governance and Accuracy in Banking:

The governance framework of the banking industry is such that there is control of generative AI outputs to ensure that there is at least a 90% accuracy of generative AI outputs.

Co-Pilot Approach:

Bala VP of generative AI and analytics at Capgemini, talked about the co-pilot’s role in which generative AI bots supervise but do not replace the human customer helpline agents, hence improving the first call resolution metrics.

At DBS Bank, the utilization of data and artificial intelligence has played a crucial element in the digitalization of the bank and the results recorded last year were more than $370m increase in revenue or expenses avoided.

The success of the bank is firmly anchored on its AI Industrialisation Programme which is a programme designed for use in the entire organization to promote and encourage the usage of AI and ML technologies in business processes not only at lower levels but also at lower costs and producing economic effects at the same time.

DBS seeks the incorporation of generative AI technologies to act as a second employee in the company, a virtual assistant, whose role is to increase productivity among workers and achieve efficiency and quality. In this way, by application of GenAI in the most creative way, they take out the hard and boring parts of their job which improves the customer journey and helps achieve better customer results.

For organizations looking to integrate AI-driven solutions effectively, platforms like Braincuber provide advanced analytics and insights that enable real-time tracking of operational improvements and customer engagement. With the right strategies and tools, businesses can harness the full potential of GenAI to drive operational excellence and create unparalleled customer experiences.

Frequently Asked Questions (FAQs)

How can generative AI improve customer service and operational efficiency?

Generative AI automates tasks, provides tailored suggestions, and enhances customer interactions, leading to increased productivity, faster product development cycles, and improved customer satisfaction.

What are the key challenges of implementing AI in Asian markets?

Implementing AI in Asian countries faces difficulties related to language diversity and the need for faster, more reliable network infrastructure to support AI applications effectively.

What role does the co-pilot approach play in AI-driven customer support?

The co-pilot approach involves generative AI bots supervising and assisting human customer service agents, which improves first call resolution and overall customer experience without replacing human agents.

How does data privacy and accuracy governance impact AI deployment in banking?

Ensuring data privacy and managing hallucination risks are critical, with governance frameworks aiming for at least 90% accuracy in AI outputs to maintain trust and compliance in banking operations.

What are the benefits of AI industrialization programs like DBS Bank’s initiative?

AI industrialization programs promote widespread adoption of AI and ML across organizations, leading to increased revenue, cost savings, enhanced productivity, and improved customer journeys through innovative AI applications.